There are some financial investment opportunities that are ideal for financiers who are more risk averse. Here are some examples.

There is a good reason that the past couple of years have actually marked a large wave of financial investment heavily concentrated on tech businesses. This is just since financiers realised that the there is much money to be made through investing in early stage start-ups that show a lot of promise. The surge of startup investment opportunities in recent years can be mainly attributed to the rising appeal of artificial intelligence businesses and stocks. AI has without a doubt showed its worth as a tool that can assist companies increase efficiency and cut unnecessary expenses. This is due to the fact that this technology can easily automate and streamline routine tasks, which frequently leads to better resource allocation. AI's analytical capabilities likewise help companies evaluate market trends and consumer behaviour, and the insights acquired can then be utilized to click here develop more effective marketing projects. This is something that the fund with shares in Marvell Technology is most likely knowledgeable about.

Whether you're a financier looking to strengthen your portfolio or somebody searching for financial investment opportunities ideal for small spending plans, there are many opportunities you can check out. For instance, investors who are more risk averse and are dealing with a smaller spending plan can go with financial products that will produce a good ROI without carrying a big quantity of risk. High-yield savings accounts, for instance, are popular choices you can think about. You merely have to do some research and shop around to find the banks the offer the greatest interest rates with the most beneficial terms. All you need to do is deposit your cash and make a preestablished interest rate for a specific time period. This investment strategy also needs little to no maintenance after investing, making it one of the best investment opportunities for passive investors. This is something that the US stockholder of Barclays can validate.

Nobody can reject that realty financial investment has constantly collected a good deal of interest as the industry's has actually long been believed to be an excellent wealth builder. In the past, investing in this space was special to the very wealthy but today, there are many small investment opportunities in property that everyone can capitalise on. You don't have to be a millionaire to invest in residential or commercial property which is largely thanks to the appeal of stock investment. Investing in publicly traded realty companies has actually turned into one of the most popular avenues because individuals can control precisely just how much they invest and for how long. This is something that the activist investor of Hammerson can confirm. This financial investment method can likewise assist individuals develop significant wealth given that they choose the ideal chances at the correct time. This sector also provides numerous investment opportunities for foreigners and institutional investors.

Michael Bower Then & Now!

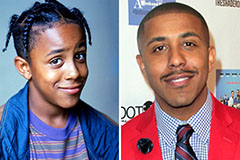

Michael Bower Then & Now! Marques Houston Then & Now!

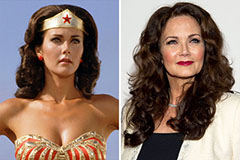

Marques Houston Then & Now! Lynda Carter Then & Now!

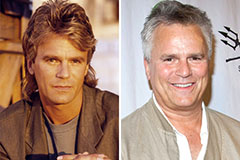

Lynda Carter Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!